BLOG

Rising Sulfuric Acid Prices in China: Strategies for Global Dye Manufacturers

If your dye production costs are under pressure from upstream price increases, or if you are concerned about delays in key raw materials, understanding the “origin story” of China’s sulfuric acid market volatility is essential. This article breaks down the ripple effects of rising raw material costs and provides actionable strategies for dye manufacturers to maintain supply chain resilience.

Market Overview: More Than Just Price Fluctuations

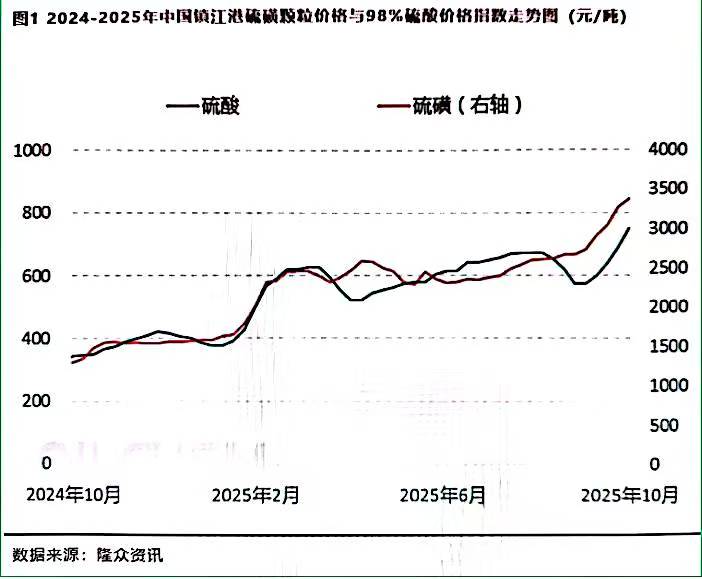

The current surge in sulfuric acid prices is driven by a combination of cost, policy, and supply chain dynamics.

The Dual Engines of Cost Pressure

Global sulfur price increases, due to supply-demand tensions, directly affect sulfuric acid costs. In addition, China produces a significant portion of sulfuric acid as a by-product of non-ferrous metal smelting. Changes in smelting output further tighten supply, creating a dual pressure on market prices.

Policy Reshapes the Supply Landscape

Environmental inspections under China’s “Dual Carbon” policies have become routine. Temporary shutdowns for maintenance or upgrades in chemical regions like Shandong and Jiangsu disrupt both sulfuric acid supply and production of critical dye intermediates, such as H-acid.

Seasonal and Structural Factors

The Q4 production peak coincides with rising winter energy costs. Coal and electricity account for about 30% of sulfuric acid production costs, squeezing producer margins and transmitting pressure downstream.

Specific Impacts on the Dye Industry

Cost Transmission Magnified

Sulfuric acid’s role in sulfonation, acidification, and pH adjustment creates a “multiplier effect.” Rising acid prices increase the production costs of intermediates like H-acid and gamma acid. Since H-acid can represent 30–50% of certain reactive dyes’ cost structure, these increases significantly impact total dye prices.

Supply Chain Stability Tested

Consistency in quality and delivery often outweighs price alone. Large corporations may hedge risks via long-term agreements, but many manufacturers need partners who can provide predictability and reliability.

Competitive Factors Shift

Global buyers are increasingly valuing “supply chain resilience + consistent quality + technical support” over purely low prices. Companies able to manage upstream volatility gain long-term trust and competitive advantage.

Building Resilience: Proactive Strategies

Monitor Leading Indicators

Look beyond spot prices. Track upstream sulfur prices (e.g., CFR China) and smelter operating rates to anticipate market shifts.Re-evaluate Supplier Criteria

Prioritize suppliers with upstream integration and vertical production structures for greater resilience and consistent output.Initiate Technical Dialogue

Engage supplier technical teams to explore process adjustments or formulation optimization, aiming for long-term cost control.

Tianjin Uniwin: A Stable Node in Your Supply Chain

We aim to be a predictable, reliable partner for clients navigating market volatility.

Our Approach:

Insight-Driven Supply Management: Monitor upstream market dynamics for sulfur, intermediates, and key inputs, guiding inventory and procurement strategies.

Focused Portfolio Built on Certainty: Sulfur dyes, direct dyes, acid dyes, and key intermediates are produced under strict quality control.

Committed to Solving Real Problems: Practical, fact-based advice helps clients manage cost challenges and process adjustments.

“During past supply disruptions, Uniwin’s upstream understanding and supply chain preparedness ensured uninterrupted production. This certainty is especially valuable today.”

— Long-term partner, Southeast Asia

Start a Conversation with Tianjin Uniwin

Professional dialogue and joint planning are the best responses to market volatility. Contact us via our website form or direct email. You may include:

The raw material or dye category of greatest concern

Specific challenges (e.g., cost structure, supply security, process adaptation)

CATEGORIES

BLOGS

- Rising Sulfuric Acid Prices in China: Strategies for Global Dye Manufacturers

- Choosing the Right Yellow Dye: Direct Yellow 11 vs 12 vs 86

- The Future of the Dye Industry: How Automated Dye Dispensing Systems Are Changing the Game

- Eco-Friendly Sulphur Dyes: The Future of Sustainable Textile Manufacturing

- Achieving Carbon Neutrality in the Textile Industry with Tianjin Uniwin’s Sustainable Dye Solutions

CONTACT US

Tel: 8613642040418

Email:info@tjuniwin.com

Add: Liutangzhuang , Zhongtang , Dagang, Binhai District, Tianjin, China